Earnings Available to Common Stockholders Is Equal to

Tips The earnings available to common stockholders are typically calculated by subtracting dividends allocated to preferred shareholders from after-tax profit. The earnings per share calculations for both companies assume that changes in shares between 2011 and 2012 occur in the middle of the year.

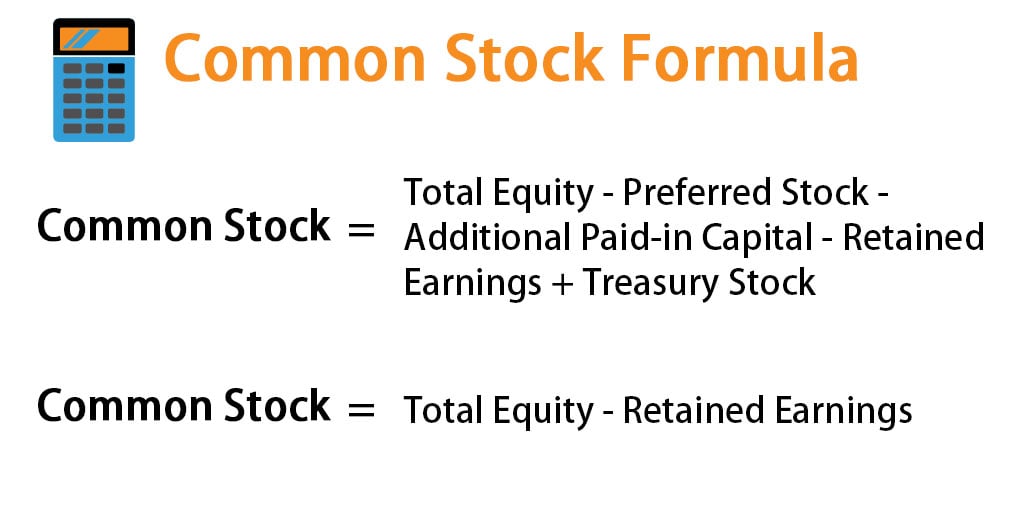

Common Stock Formula Calculator Examples With Excel Template

A before taxes minus preferred dividends B after taxes minus preferred dividends.

. The reason preferred dividends are deducted is that EPS represents only the earnings available to common shareholders and preferred dividends need to be paid out before common shareholders receive anything. 7 Common stock dividends paid to stockholders are equal to the earnings available for common stockholders divided. Ed out of True lag question False.

The net income applicable to common shares is equal to the amount of after-tax profit available minus the required profit that must first be allocated to preferred shareholders. 11 Common stock dividends paid to stockholders is equal to the earnings available for common stockholders divided by the number of shares of common stock outstanding. What is Earnings Available for Common Stockholders.

The formula for calculating retained earnings RE is. Newell is more financially stable than Bradshaw. Net income preferred dividends.

Earnings available to common shareholders is determined by profit and loss account or income statemen. The state charter allows a corporation to issue only a certain number of shares of each class of stock. Earnings available for common stockholders is net after-tax profit minus any preferred dividends.

Includes retained earnings and paid-in capital d. View the full answer Previous question Next question. The earnings available to common stockholders is decreasing for Newell and increasing for Bradshaw.

Net income preferred stock dividends. A return on equity financial leverage multiplier B return on equity total. Net income preferred dividends.

TF Earnings available to common shareholders is equal to a corporations positive net cash flow over a given period typically one year. When subtracting the expenses from the revenue this translates to net income of 2302 billion. Earnings available to common stockholders is equal to net income - preferred dividends In the statement of cash flows Net cash provided by operating activities indicates the cash-generating capability of the company.

Both firms distribute all earnings available to common stockholders immediately. Since every share receives an equal slice of the pie of net income they would each receive 0068. Preferred dividends net income.

Earnings available to common stockholders is equal to a. RE Beginning Period RE Net Income or Loss - Cash Dividends - Stock Dividends Net income increases retained earnings whereas dividends drain them. Net income Preferred stock dividends c.

Includes retained earnings and paid-in capital. Net income Preferred stock dividends Ans. LegalRegulatory Perspective AICPA FC.

Cash Receipts from operating activities 980. Includes paid-in capital and liabilities. Earnings available for common stockholders is calculated as net profits _____.

View the full answer. Year 20X2Earnings after taxes 640000 134 857600 Shares outstanding 375000 100000 475000 Earnings per share857600 475000 181 Prepare an. Cash The fact that earnings are available to.

Theoretically the remainder represents the amount of earnings that a business could pay out to the owners of its common stock. Net income preferred dividends. Preferred stock dividends net income.

LegalRegulatory Perspective AICPA FN. So the earnings available to common stockholders would be 15 million minus 12 million or 138 million. After subtracting the roughly 142 billion.

False The DuPont formula allows a firm to break down its return into the net profit margin which measures the firms profitability on sales and its total asset turnover which indicates how efficiently the firm. Earnings available to answer -issues-and-challenges-of-technology-and-digitalisacommon stockholders is equal to. Earnings available to common stockholders is equal to.

Earnings available to common stockholders is equal to a. 12 The income statement is a financial summary of a firms operating results during a specified period while the balance sheet is a summary statement of a firms financial position at a given point in time. Day Knight Projected operating 750000 750000 income Year-end interest on debt 77500 Market value of stock 3600000 2300000 1550000 Market value of debt a-1.

Preferred stock dividends Net income d. True The following information is available for Cooke Corporation. Preferred stock dividends Net income d.

Net income Preferred stock dividends c. Dividends can take the form of cash or stock. Earnings per share Earnings after taxesShares outstanding 640000375000 171 b.

Preferred stock dividends Net income d. However the reported amount of earnings may be higher than the amount of cash reserves of the business so the firm. In the DuPont system of analysis the return on total assets asset is equal to _____.

By comparing earnings per share of a single corporation over time a shareholder can evaluate the corporations relative earnings performance. Retained earnings contain the net accumulated earnings available to the corporations stockholders. Theoretically the remainder represents the amount of earnings that a business could pay out to the owners of its common stock.

Earnings available to common stockholders is equal to 98. Earnings available to common stockholders is equal to a total revenues b net from MATH AC214 at Monroe College. Earnings available to common stockholders is equal t o.

Finance questions and answers. Earnings available for the common shareholders of a company equals to the Net Income of the c View the full answer Transcribed image text. All earnings streams are perpetuities and neither firm pays taxes.

Net income Preferred stock dividendsc. Common stock dividends paid to stockholders is equal to the earnings available for common stockholders divided by the number of shares of common stock outstanding. Net income Preferred stock.

Earnings available to common stockholders is equal toa. Net income preferred stock dividends Answer d. Is usually equal to cash on hand.

Earnings available for common stockholders is net after-tax profit minus any preferred dividends. Is shown on the income statement. Tion 32 Earnings available to common shareholders is equal to a corporations positive net cash flow over a given period typically one year.

Basic Earnings Per Share Eps Formula And Excel Calculator

Information On How Basic Financial Transactions Effect The Retained Earnings Statement And Stockholders Equity Equity Finance Class Everyday Journals

A Corporation Is Not An Entity That Is Separate And Distinct From Its Owners In 2022 Separation Corporate Owners

No comments for "Earnings Available to Common Stockholders Is Equal to"

Post a Comment